Future-proof your business to stay relevant for the next generation.

Open insurance brings opportunities to increase customer satisfaction, as the relationships between insurance companies and their customers are becoming more important to nurture than ever before. In order to learn more about the younger generations’ behaviors and attitudes regarding insurance, we conducted a survey together with one of the world’s leading companies for insights and analytics, Kantar Sifo.The results show clear trends to think about as an insurer going forward.

As the demands of customers are developing, the need for companies to keep up with the latest digital transformation and data sharing is growing. Young generations have different needs and habits than those who came before them, such as less loyalty to brands and more focus on new technology. Confirming recent studies, our survey showed that younger generations have different needs and changing relationships with their insurers than previous generations. Those who cater to their needs now will benefit in terms of better business outcomes and the opportunity of a leading market position. Not to mention how much the customer experience will improve; a win-win for everyone involved.

Adapting to future generations.

Since many Gen Z’ers (people between the ages of 10 to 25) don’t have insurance today, the survey did not include them. However, as they are the largest generation on earth, accounting for 32% of the global population, and soon will start buying insurance, reflecting now on how to cater to their needs is important for future-proofing your business. They grew up not only digital-first but mobile-first, meaning that companies must adapt to their technology-driven, device-defined, constant connectedness, their high expectations, and short-attention-spans kind of living. In addition, they tend to be less loyal to brands and don’t have the same connection to big, familiar brands as previous generations.

Millennials (people born in the early 1980s to mid-1990s, also known as Gen Y) are similar to Gen Z in that they aren't loyal to brands and, instead, are more focused on costs. They have, however, grown up with digitalization in a different way. While Gen Z expects high-tech innovation, Millenials are more used to simplicity and accessibility, anticipating personalized, tailored offerings and platforms that are easy to navigate. When offering the technology these generations expect along with offerings suited to their demands, the possibilities of winning them over as customers will increase enormously.

Young generations' insurance behaviours.

We conducted the survey with the help of Sifo earlier this year with the aim to help the industry with data and insights to better understand consumer attitudes toward their insurance. The respondents were between the ages of 25-80, from different parts of Sweden, and with a wide variety of household income per month.

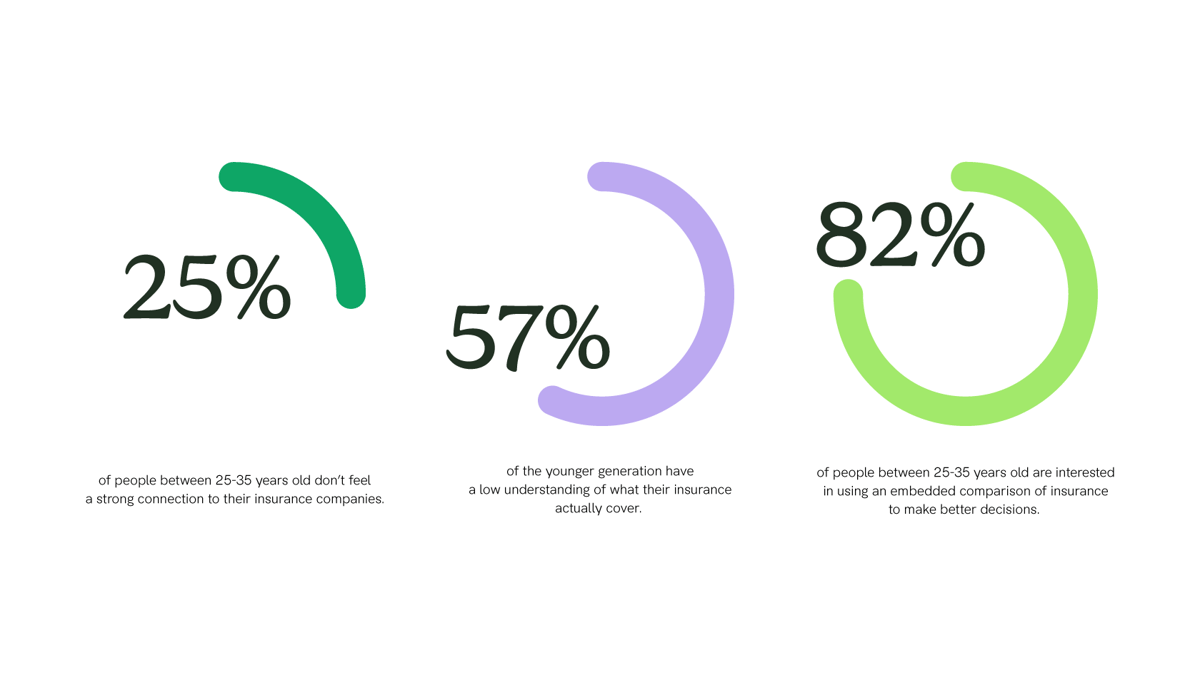

Three significant trends were visible in the respondents’ survey answers, especially for the age group 25-35 (26,4% of respondents), who stood out from the rest. The results showed unmistakable trends, illustrating what the insurance sector needs to do to adapt to young consumers’ expectations and demands.

One of the most significant trends from the survey was the young generation’s lack of connection to their insurance company, where almost 25% of the respondents don’t agree with the statement, “I feel a strong connection to my insurance companies”. The results also show that not even half of the younger generation understand what their insurance actually covers, and that they have a high interest in insurance challenger services, indicating a need for more transparency and adaptability from the insurance industry.

One key factor to remember is how Millennials perceive and interact with insurers compared to older generations. The fact that Millennials demand more transparency from their insurers and are likely to use challenger services are just two indicators of what the insurance industry will look like in the near future and what kind of challenges are created for the industry going forward when facing Gen Z and younger generations.

The time is now.

Given the survey responses above, it’s evident that there’s a fast-paced, growing need to future-proof the insurance industry by preparing it to cater to the needs of the coming generations of adults. Clearly, it’s time to look into which digital updates are needed.

Open insurance creates more open relationships between insurance companies and their customers based on trust, understanding, and data – a win-win for everyone involved. When you’re ready, we’re here to help you grow your business through the power of open insurance.

Want to read the full survey? Contact us, and we’ll get back to you shortly.