Insurely enters Danish market - Collaborates with UNDO to increase transparency for car insurance

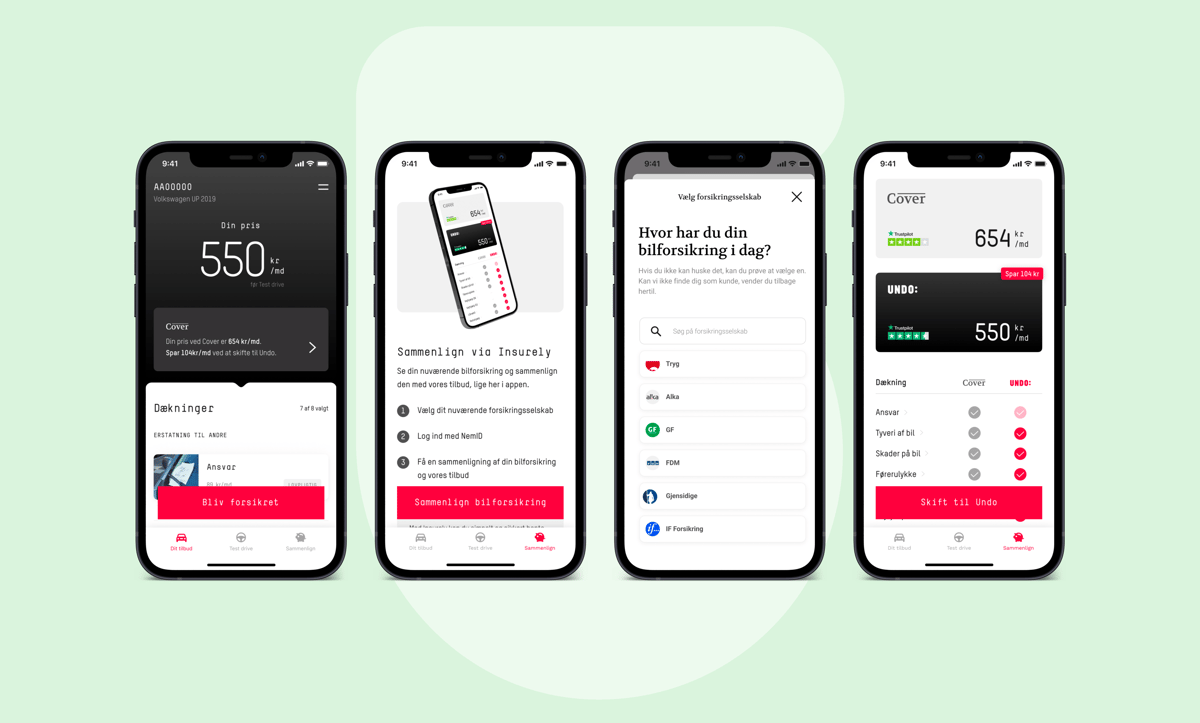

Undo becomes the first insurance company in Denmark to collaborate with Swedish Insurtech company Insurely. Insurely’s solution will be incorporated into UNDO’s car insurance app “Kør”, allowing consumers to compare insurance by simply logging in using digital identification system NemID.

Open banking has been a hot topic for years, with companies like Klarna, Tink and Apple Pay leading the way. Now it’s the insurance industry’s turn to take a step towards becoming more transparent and consumer-friendly. Today, it’s difficult for consumers to know if they are correctly insured. Insurely and UNDO want to help consumers get a better understanding of their insurance, allowing them to compare their existing insurance contract with UNDO’s offering.

Since the start in 2018, Insurely has expanded and now offers open insurance in several markets. UNDO becomes the first insurance company in Denmark to collaborate with Insurely, aiming to provide their customers with a possibility to make well-informed decisions when considering switching their car insurance policy.

Lotta Rauséus, COO & co-founder of Insurely, explains that open insurance has already progressed quickly in the Swedish market and that interest has been high. According to her, it’s very clear that it’s the future of the industry and something that benefits insurance companies and consumers alike.

“Our open insurance solutions have several benefits for consumers as they get insights about their insurance and in addition to that, it gives insurance companies valuable insights about their customers so they can tailor their offering to their needs and wants. It’s simply a win-win”, Lotta explains.

Implementing Insurely’s solution into UNDO’s car insurance app “Kør” is the first step of the collaboration. All car owners can simply download the app and try it out for free. The user logs in through digital identification system NemID, giving them access to share their existing car insurance data from another company. The data is used in UNDO’s app to enable a comparison of their offering and the customer’s existing policy, both in terms of price and coverage. It also provides UNDO with information such as the expiration date so they automatically know when the new one should start. Not only is this smooth to use, but it’s also safe for the customers.

Sophie Grønbæk Bohr, CEO at Undo, feels that the insurance industry has been falling behind compared to other industries when it comes to creating transparency for their consumers. Through the collaboration with Insurely, UNDO’s customers will get a smoother and more frictionless customer experience.

“We owe it to ourselves as an industry to help people make informed decisions about their insurance. Once we connect more of our insurance offerings to Insurely’s service, it will get even easier for customers to make quick and informed decisions about their insurance, hopefully saving time, money and unnecessary worry”, says Sophie Grønbæk Bohr, CEO at Undo.

During this first phase, Insurely’s solution will only be available for UNDO’s car insurance. However, the ambition is that over time, it will be available for all lines of business.

For more information, please contact:

Louise Åsheim, Head of Marketing

+4670 - 89 750 67

Email: louise@insurely.com

.png?width=580&height=280&name=Insurely%20Citadele%20(1).png)