Open finance - what it is and how it works.

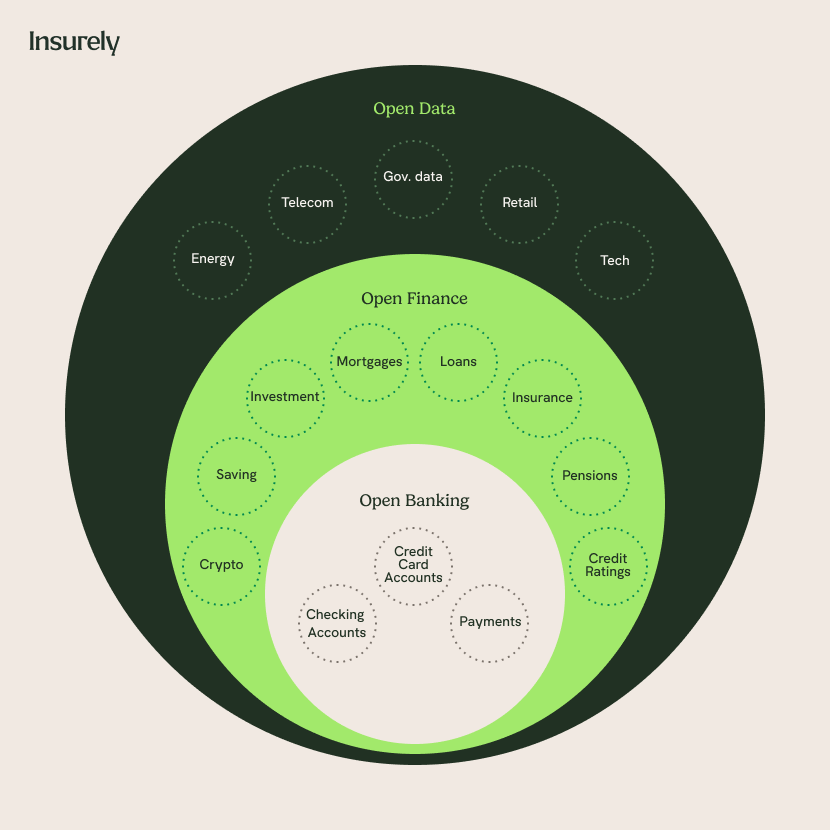

Building upon the principles of open banking, open finance takes the concept of data sharing and collaboration beyond banking services. Open finance embraces a broader range of financial products and sectors, including insurance and pensions, aiming to create an interconnected ecosystem that empowers consumers and encourages competition and innovation.

What is open finance?

Open finance refers to a concept that extends the principles of open banking into a broader financial ecosystem. It involves the use of technology and data sharing to create a more interconnected and transparent financial environment, beyond just banking. Open finance aims to empower consumers by giving them greater control over their financial information and enabling them to access a wider range of financial services and products from various providers.

Open finance data.

Open finance data refers to financial information and data that is made accessible, shareable, and usable by various entities within the broader financial ecosystem. It encompasses a wide range of financial data, including transaction history, account balances, investment data, insurance data, and more. Examples of open finance data can be bank account transactions, insurance coverage and policy information, savings portfolio data, and pension data.

Here is a graphic explaining how open banking, open finance (including open insurance), and more general open data relate to each other.

Open finance APIs.

Open finance APIs (Application Programming Interfaces) are a set of protocols, tools, and definitions that enable the secure and standardized exchange of financial data and services between different financial institutions, businesses, and third-party developers. These APIs facilitate the integration of various financial services, products, and data sources, allowing them to communicate and interact with each other seamlessly.

Open finance APIs play a crucial role in the open finance ecosystem by enabling the sharing of data and functionalities across different financial platforms. They allow authorized third parties, such as fintech startups or other financial institutions, to access specific financial information and services offered by banks, insurers, investment firms, and more. This accessibility promotes competition, innovation, and the creation of new services that can enhance the customer experience.

For example, open finance APIs can enable a customer to view their bank account balance within a third-party budgeting app, initiate payments from their preferred banking platform, or aggregate data from various sources to gain a comprehensive overview of their financial situation. These APIs ensure that data sharing is done securely, following industry standards and regulations, while providing customers with greater control over their financial information.

Examples of how open finance is reshaping the industry.

Through the power of open data, open finance is reshaping traditional practices and introducing innovative solutions that cater to personalized needs, always with the consumer in mind. Here are a few examples:

-

Improved customer experience: Open finance enables access to a broader range of financial data, allowing customers to receive personalized insights and recommendations. With a comprehensive overview of their financial situation, customers can make informed decisions tailored to their unique goals and needs.

-

Investment platforms: Open finance extends to investment platforms, where customers can link multiple investment accounts from various providers to a single dashboard. This provides a comprehensive view of their investment portfolio, aiding better decision-making.

-

Insurance comparison: Open finance APIs can enable insurance comparison platforms that provide customers with personalized insurance options based on their financial data and coverage needs.

-

Bancassurance: Bancassurance refers to the collaboration between banks and insurance companies to offer a comprehensive range of financial products and services under one roof. This partnership leverages open finance principles by integrating banking and insurance services, providing customers with seamless access to insurance offerings through their existing banking channels.

-

Pension management and transfers: Open finance enables the movement and management of pensions in a more streamlined and convenient manner. Currently, pension transfers can be complex and time-consuming due to various administrative processes and paperwork involved. However, with the integration of open finance principles and APIs, the process can be significantly improved.

-

Cross-border payments: Open finance can facilitate cross-border payments by allowing customers to link their accounts across different currencies and providers, minimizing currency conversion fees.

Open finance framework.

The term "open finance framework" refers to a structured approach or set of principles that guide the EU implementation and regulation of open finance practices within the financial industry. It is called an "open" framework because it emphasizes transparency, collaboration, and accessibility in the financial ecosystem. The framework sets out guidelines for how financial data can be shared, accessed, and utilized by various stakeholders, including financial institutions, fintech companies, and consumers.

The European Commission released a draft for an open finance regulation on June 28 2023. This represents a significant step towards establishing a regulatory framework for open finance practices. The draft outlines the principles and guidelines for financial institutions to share customer data securely with authorized third-party providers through standardized APIs. This draft aims to promote transparency, competition, and innovation within the financial sector while prioritizing data privacy and customer consent.

Introducing Insurely's position paper on FIDA.

FIDA, the Financial Data Access regulation, represents a pivotal regulatory framework that is reshaping the landscape of finance. In this position paper, we delve into the critical implications of FIDA for consumers, businesses and the broader financial ecosystem.