01. During or ahead of a call or meeting

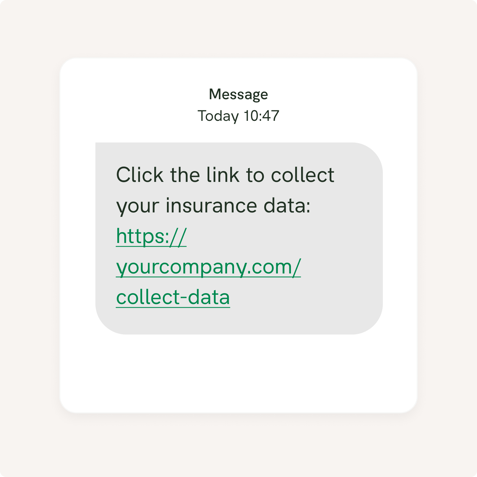

Ahead of, or during an interaction with an advisor the user gets a link to a webpage where they can collect their insurance data and share it with the advisor.

The webpage can also work as a lead generator, generating hot prospects for your advisors to call.

.png?width=477&height=480&name=Frame%2045249%20(1).png)

.png?width=477&height=480&name=Frame%2045255%20(1).png)

-min.png?width=947&height=1081&name=Img%20(8)-min.png)