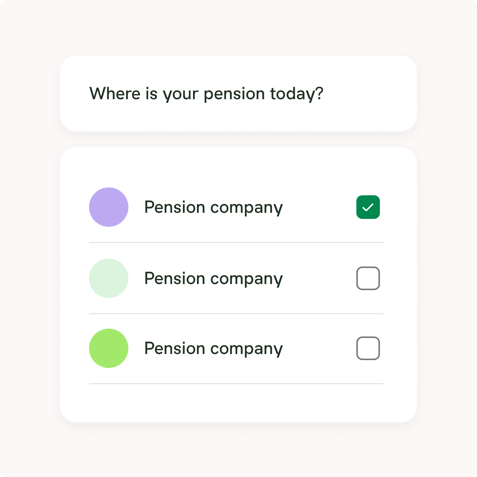

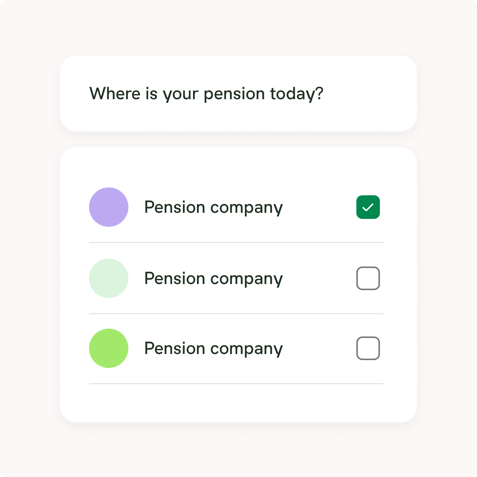

01. Pension provider selection

The user enters the flow in your app or on your website and selects the savings providers they want to collect their pension data from.

Increase your Assets under Management by making it simple for consumers to collect, view, and move their pensions to your services.

The user enters the flow in your app or on your website and selects the savings providers they want to collect their pension data from.

The user then authenticates themselves towards their current savings provider using single sign on or username and password. At the same time, they give consent to Insurely to collect data on their behalf.

After consent has been obtained, Insurely collects the user’s savings and investment data on their behalf in real-time. The data is collected, cleaned, standardized and returned to the third party within seconds.

.png?width=477&height=480&name=Frame%2045267%20(1).png)

The data can now be used by the third party for a number of different use cases, including increasing assets under management, improving advisor quality, and retaining customers. It’s also common to display the collected data for the user to help them understand their current savings.

Grow your assets under management by making it simple for consumers to move their pension savings to you.

-min.png?width=947&height=1081&name=Img%20(2)-min.png)

Offer a holistic financial experience that is good for your customers and your bottom line.

-min.png?width=947&height=1081&name=Img%20(2)-min.png)

By making it easier than ever for customers to move their savings to you, more people will take action, resulting in growth in your assets under management.

By looking at the customer’s own data, advisors instantly see what actions your customers can take to improve their financial future, which results in better advice.

Become the one place to go for all things pension by helping your customers collect, view, and understand their savings and investments from different sources in one place.

"Together with Insurely we are now digitalizing the industry and making it easier than ever to transfer pensions and get a better overview of all your pension savings."

.jpeg?width=2048&height=1365&name=asa-mindus-soderlund-2022%20(1).jpeg)

Data points processed daily.

The total amount of insurance policies and pension plans that have been collected and shared through Insurely in the past 6 months.

Advanced technology, with exceptional market coverage and data security, and years of experience at your tech team's disposal.

-min.png)

Pension Data Access provides you the ability to collect and use pension data directly from your customers’ current savings providers in real-time. This data can then be used for a number of different use cases. To use the data for your use cases, you can access the collected investment data through a few different data access methods, including APIs, our pre-built user interfaces, and through Advisor access.

Visit our documentation to get more details about how Pension Data Access works from a technical perspective or contact us.